Checklist Inspections has been helping potential homeowners since 1998 to have peace of mind when purchasing their dream homes. We know the importance of being well informed by highly educated, experienced, and caring home inspectors. Our office staff are available 7 days a week to schedule your inspections. We do all that we can to ensure that the inspection process is one of the easiest and most informative steps in the purchasing process for you.

What is a Cost Segregation Study?

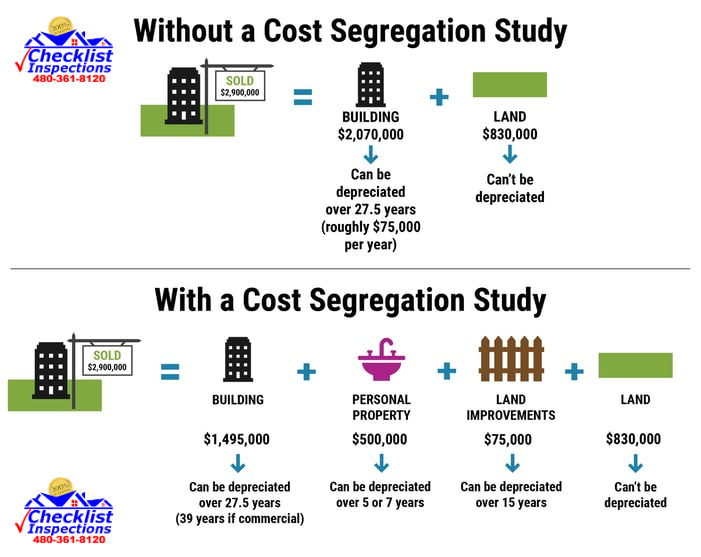

A cost segregation study is a tax strategy that helps property owners, whether individuals or businesses, reduce their tax bills. It works by speeding up depreciation on certain parts of a property, which allows you to write off more of the property’s value in the early years of ownership. This means you can save money on taxes right away. Essentially, it involves breaking down a property’s purchase price into different categories (such as personal property, land improvements, and real estate), so you can depreciate parts of it faster and reduce your taxable income in the short term.

Is Cost Segregation Worth It?

Whether a cost segregation study is worth it depends on your specific situation. Some important factors to consider are:

For some real estate investors, the cost of conducting the study is offset by the tax savings they get right away. However, if the property doesn’t have many components that qualify for accelerated depreciation, or if you have large tax losses that can’t be used, the study might not be worth the cost. Also, if you’re subject to certain tax rules or if you don’t benefit from the depreciation deductions, the value of the study could be reduced. It’s a good idea to speak with a tax professional to see if a cost segregation study makes sense for you.

Example of Cost Segregation

Let’s say a real estate investor buys a commercial building for $10 million. Without a cost segregation study, they would depreciate the building over 39 years, which would give them a tax deduction of about $205,128 per year.

However, after a cost segregation study, the investor might find that $800,000 of the building qualifies as 5-year personal property (items like furniture, fixtures, and equipment), and another $800,000 qualifies as 15-year land improvements (things like parking lots or landscaping). By reclassifying these portions of the building, they can take advantage of bonus depreciation, allowing them to immediately deduct 80% of the $1.6 million (i.e., $1.28 million) in the first year, in addition to regular depreciation on the remaining $6.72 million.

In short, a cost segregation study can give you bigger tax savings early on, which might make a big difference, especially for large commercial properties.

Process of Conducting a Cost Segregation Study

The process of conducting a cost segregation study starts with a thorough review of the property’s construction costs or purchase price breakdown, along with any relevant architectural plans and documents. Next, an expert will visit the property to take photos and examine the various assets. Based on the site visit and data gathered, the costs are then allocated to specific categories that qualify for different depreciation schedules. Afterward, a detailed report is created that supports the findings and ensures the study can withstand potential IRS review.

Identifying Assets Eligible for Accelerated Depreciation

Not all parts of a property can be depreciated more quickly. A cost segregation study helps identify which assets are eligible for accelerated depreciation, meaning they can be written off faster for tax purposes. These assets include:

By identifying and reclassifying these components, a cost segregation study can help property owners claim faster depreciation and reduce their taxable income.

Calculating Tax Savings Through Cost Segregation

A cost segregation study mainly helps property owners by accelerating depreciation deductions, which increases the amount they can deduct in the current year. By reclassifying assets into shorter depreciation schedules (e.g., 5 years instead of 39 years), the study helps lower your current-year tax liability. However, the tax savings will vary depending on the types of assets identified and the property owner’s individual tax situation.

It’s important to consider factors like passive activity rules and the structure of ownership, as these can affect how depreciation impacts your taxes. For example, if you can’t use the extra depreciation to offset income from other sources, it might not provide as much immediate benefit.

Accelerated depreciation is essentially a timing difference. While you’re getting more depreciation upfront, you’ll need to account for it when you sell the property. When you sell, you may have to “recapture” the depreciation, meaning the gain on the sale could be higher than if you hadn’t accelerated depreciation.

Common Misconceptions About Cost Segregation Studies

Some property owners assume that cost segregation studies will always benefit them. However, the real benefit comes when owners need a current tax break. If you’re in a situation where you don’t need to reduce your taxable income right now, the upfront savings might not be as valuable.

Consulting a tax professional is crucial. They should have a solid understanding of real estate and your specific tax situation. It’s important to avoid working with someone who promises benefits without fully understanding your needs or tax position.

Another common concern is the risk of audits. While some property owners worry about the IRS reviewing their cost segregation study, rest assured that these studies are based on IRS guidelines. When done properly, they can withstand IRS scrutiny. Typically, the benefits of accelerated depreciation far outweigh the potential risks.

Conclusion and Next Steps

For many businesses and property owners, maximizing tax savings is a key priority, and a cost segregation study can be an effective strategy to reduce tax liability and unlock hidden benefits. To determine if a cost segregation study is the right choice for your property, it’s essential to understand the process, the potential benefits, and any limitations. By working with experienced professionals, property owners can make an informed decision and ensure they are getting the best possible tax advantages.

Get Your Quote Today

5-Star Inspections

Get Your Quote Today